I am happy to announce that today, for the first time in 31 years, the House of Representatives passed the first significant tax reform. Since 1986, Americans have been forced to stand idly by as our state and local governments took more and more of our hard-earned dollars.

Thankfully, today, the House of Representatives said no more.

After numerous conferences, meetings, committee hearings and public debates, we were able to pass major tax reform that puts American families and the middle-class first.

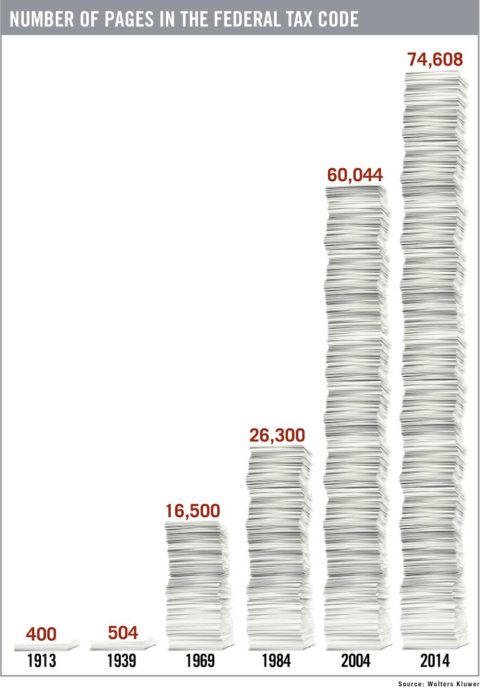

The final product isn’t perfect but gets us started and overhauling an archaic and overly burdensome tax code. And most importantly, Congress listened to the American people and made changes that were demanded.

But, we need your help to get it over the finish line. The Tax Cut and Jobs Act still has to pass the Senate, and as we saw with health care, that’s easier said than done. We cannot let the hard work of the house die in the Senate once again. So, in the coming weeks, let your Senators hear from you. Write them emails and call their offices, place letters to the editor in your local papers, and make your voice heard.